The minutes from the federal reserve committee gave us some more information to the state of the economy and the end of QE. At first glance the fed announced there would be no taper and the markets jumped up quickly (Treat) but the Fed left open the possibility of tapering earlier than the market originally thought (Trick) and stocks sold off.

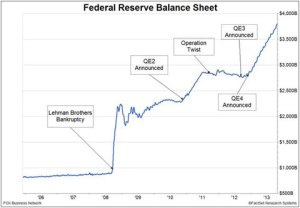

There are a few things to think about when discussing Fed policy; First, If the economy is doing well, why does the US need trillion dollars of liquidity added every year? Secondly, has it gotten to the point where the fed is now in a conundrum with its policy? If they stop, will the economy stop and if they continue will it create a bubble that will burst? The Feds have eased long enough. Granite Group’s perspective: It is time to dramatically slow and eventually stop the tapering process as we are creating the biggest “Trick” of all, bankrupting the US Government. The chart below looks more like a bubble than a sound fiscal or monetary policy.

You can follow Granite Group Advisors on LinkedIn and learn more about our Corporate Retirement Services and Wealth Management in our Website.